Ripple is set to release a significant amount of XRP tokens on January 1st. This event, occurring on the first day of each month, involves the unlocking of 1 billion XRP tokens from Ripple’s XRP Ledger escrow system. The upcoming release, scheduled for a Monday, will involve transactions totaling $620 million in three separate batches: 100 million, 400 million, and 500 million XRP.

This release in January 2024 represents a notable portion of the XRP in circulation. Specifically, it accounts for 1.84% of the existing 53.56 billion circulating XRP and 2.17% of the 45.87 billion XRP still under Ripple’s management. These tokens are part of a larger cache set to be systematically released each month until May 2027.

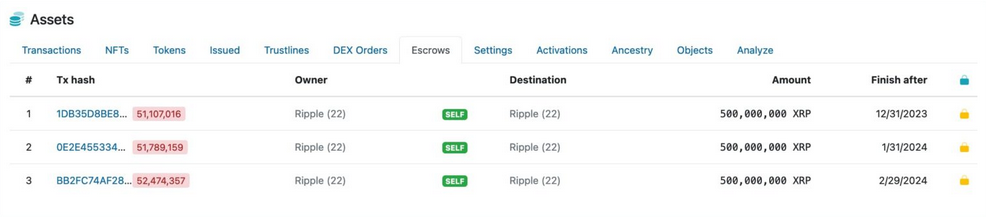

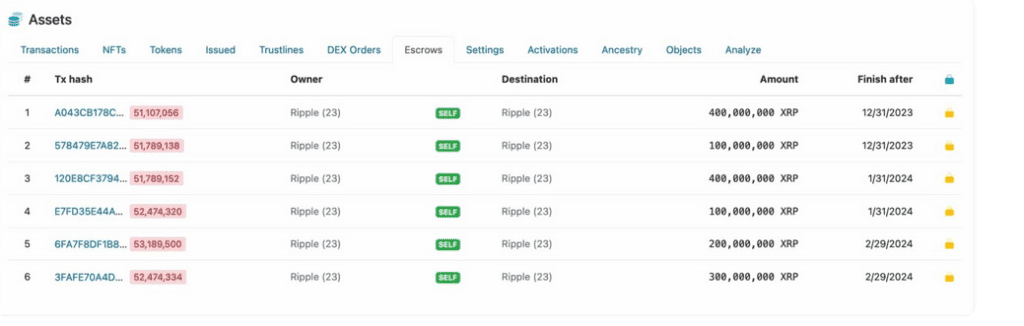

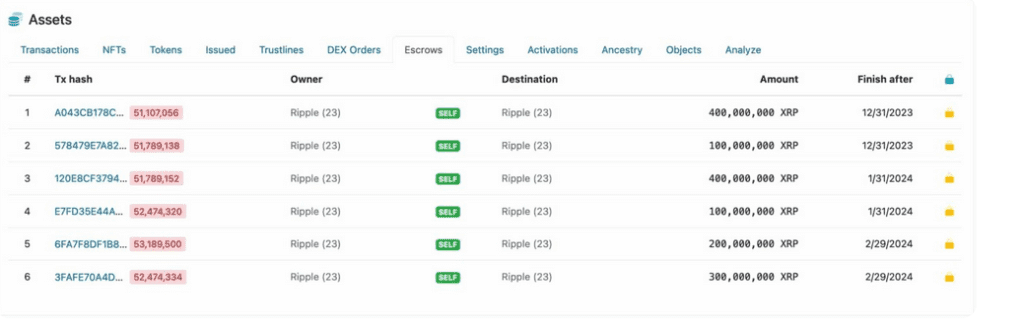

The unlocking process involves three escrows, set to conclude in the final moments of 2023. These escrows are linked to two well-known Ripple-owned cryptocurrency wallet addresses. Notably, the address labeled ‘Ripple (22)’ will release 500 million XRP, a quantity initially secured in escrow in November 2019.

Additionally, another Ripple wallet, identified as ‘Ripple (23)‘, is scheduled to release 500 million XRP in two segments: 100 million and 400 million tokens. These were initially placed into escrow in December and November 2019, respectively. Collectively, the two Ripple wallets, ‘Ripple (22)’ and ‘Ripple (23)’, currently hold a reserve of 2 billion XRP. This amount is earmarked for sequential monthly releases, which will continue until March 1, 2024.

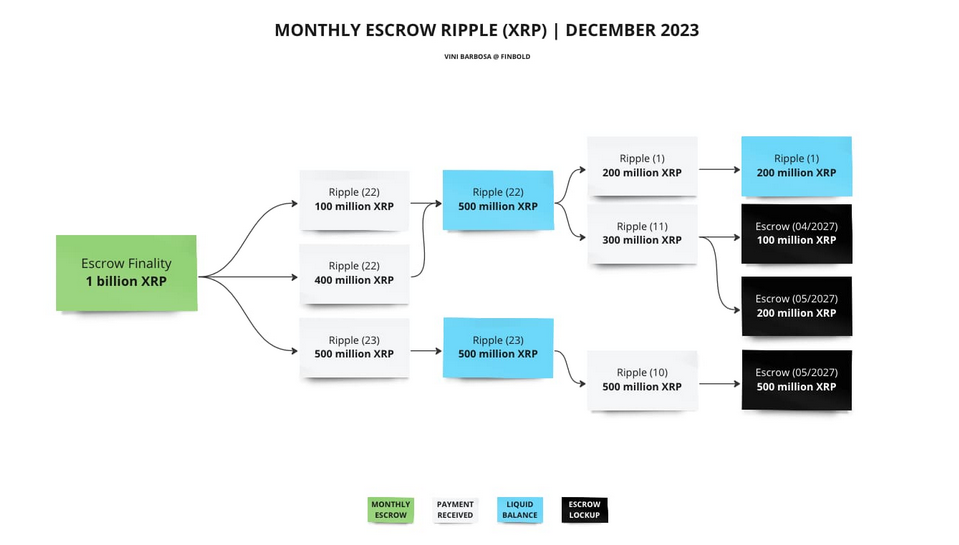

This is what Ripple did to the 1 billion XRP released in December

On December 1st, in line with expectations, Ripple successfully unlocked 1 billion XRP tokens. Following this, the company promptly re-secured 800 million of these tokens, equivalent to 80% of the total unlocked amount, into new escrows. These are scheduled for finalization in the months of April and May 2027.

Remarkably, Ripple retained only 200 million XRP from the unlocked tokens, yet the firm expended 310 million tokens, valued at approximately $192 million, from its primary wallet, ‘Ripple 1,’ during December. This outflow was structured in four weekly transactions, all directed to the same recipient address, identified as ‘rP4X2…Kxv3‘:

Initially, on December 1, Ripple transferred the 200 million XRP to its reserve holdings. Following this, the payment protocol executed two separate transactions of 60 million XRP each on December 6 and December 12. Then, a larger transaction of 120 million XRP was made on December 20. The final transaction of the month, involving 70 million XRP, took place on December 27.

How does the escrow system work for Ripple unlocks?

Ripple, established in 2012, initially issued 100 billion XRP tokens with a fixed maximum supply. The company allocated 20 billion XRP to its founders and core team members.

The remaining 80 billion XRP were held by Ripple’s treasury, with a commitment to release these coins gradually, rather than all at once. To enhance transparency and control in this process, Ripple introduced a new mechanism in 2017.

This mechanism involves escrow accounts — a type of smart contract that securely locks away XRP, rendering them unusable until specific criteria are met. Ripple’s chosen condition was to release one billion XRP on the first day of every month for a total of 55 months, adding up to 55 billion XRP.

Despite the scheduled monthly release of one billion XRP, Ripple has often only used or sold a fraction of them. Instead, the company frequently re-locks the unused portion of these monthly releases into new escrows, effectively extending the original 55-month timeline for the full circulation of XRP.

These activities result in the inflation of XRP’s supply, as the unlocked tokens enter the market each month. Ripple’s actions in managing these releases can significantly influence the economic ecosystem surrounding its token, affecting its future price and value. This strategy has been detailed in previous reports by financial news outlets like Finbold.

Note: The information provided here should not be construed as investment advice. Investment in the financial markets is speculative and carries inherent risks, including the potential loss of capital.

Source: finbold.com